Commercial Property Auctions

Author: Helen Tarrant | Unikorn Commercial Property

In the last three to six months, with the rate rises, we’ve seen more auctions in commercial property than ever before. Today we are going to look at tips, tricks and myths about commercial property auctions.

When I first started in the industry, it was mainly ‘expressions of interest’ and ‘private treaty’, but over the years we’ve gone to auction format. Really, it’s the vendor wanting unconditional contracts. They don’t want you to do your due diligence and they want to know that you’re going to buy the property regardless of whether your finance is ready or not.

So, how do you guarantee that you’re going to get a good deal when you’re going to a commercial auction? The simple answer is to do your due diligence and make sure you are armed with as much information about the property before you get there.

Sometimes, you really don’t have time to line up your finance because you don’t know what price you’re going to get the property for at auction. If you don’t have time to get a valuation, you need to make sure you get the longest possible settlement that you need at the other end. So, the number one thing I look at if there’s a property I really like is to get an extended settlement.

If I’m in Melbourne I can get 30 / 60 / 90 days. I always try for 90 days (failing that, I push for 60 days), because I know that I can get a ‘Lease Doc’ loan failing everything. A lease doc loan does not require full evidence of your income, instead the lender relies on the strength of the rent income from the property used to secure your loan. So they are similar to a low doc commercial loan: You can borrow up to 70%* of the property value. That’s a safeguard with commercial properties that Lease doc loans can be done between four to six weeks. So, as a rule 60 days for settlement should be fine but you are better to maximise your time if possible.

Now if you’re in New South Wales, it’s normally a 30 day option. We try to push for 42 or 60 days. In NSW, very rarely do you get 90 days.

do you get 90 days.

In Queensland you can nominate, but most of the time it’s 30 days again. And of course, we try to get 60 days for settlement.

So, overall, we try to push for at least 60 days as much as possible to line up the finance on the other end. Of course, you never know what the valuation is going to come in at. So if there is a property that’s fairly large, and you’re not sure whether you’re going to be able to get the value coming in on price, one of the things that you need to do is get a pre-purchase valuation, which costs anywhere from $1500 to $2500 depending on who you use.

Typically you use the same valuers as you would if you were going through the bank. Of course, you’re instructing them and not the bank, so their criteria is going to be a little bit different. Let them know that you want them to value it as if they were valuing for the bank and they will look at things a little bit harsher, they’ll get some different comparisons for the property and give you more accurate ideas on whether you’re going to be able to come up with the valuation you need to proceed. But with pre-purchase valuations, you need to understand that if you were not the winning bidder then you forfeit the cost as well.

It’s so important that you line up your finances in the back end before you go to auction. You need to make sure:

- you’ve got enough deposit, make sure you’ve already checked with your finance broker or the bank

- you can get the finance

- you are happy with the rate

- You know (& understand) the terms

But the most important thing to think about is actually ‘due diligence‘. This is where the tips and tricks come in. The myth is that at auction you get your best deals, but they actually work for the vendor more times than they do for a purchaser. So you need to make sure you don’t over bid. You have to know your numbers, and you have to know where it is you’re stopping – your ceiling. Because that is where most people make the mistake. They go in and they buy too high or they go in and what the agents given you is misleading. I can tell you right now categorically, almost all agents are going to give you a lower end amount for you to come in to encourage everyone to bid against each other.

For example, the last auction I went to (about a month or so ago), the agent gave me an indication between 2.6 or 2.8 million. I turned up to the auction and all of a sudden the vendor wants 3.2 million. If I had known that, I wouldn’t have attended the auction. I’ve got our client prepared, so prepared to buy. We’re trying to line up the finance the back end, we’ve got a verbal expectance that will finance against the property and we did our DD (due diligence) and we know the rough valuations in the area. So we’re ready to buy and we were happy to go to even $2.95m at the time, but the vendor tried to get to $3.2m. And that was only reviewed at the auction at $2.95m. We were actually the highest bidder and the vendor wouldn’t sell. He didn’t even meet his reserve. Now, if I knew that, then I wouldn’t have gone to auction at all, it was a complete waste of time. But these are the some of the things that you need to be prepared for – you’ve got to do your due diligence! So site inspection is really important when you’re buying an auction property because they’re trying to rush the process.

So most time most people buying auction properties are sight unseen at the moment. So for you, it’s most important that you get someone you trust, or someone you know, or go and inspect the property yourself. Get to know the tenant. Know the area. Walk around the area. This gives you a sense of peace and calm when you go to auction because you know how much you’re willing to pay for it at that time. By going and sighting it gives you a level of confidence you wouldn’t otherwise have. So make sure you do that if you can, do a pest and building inspection. Ask if they’ve got a pest and building inspection done previously.

That’s why the site inspection is so important, because if you can’t do a pest and building inspection there’s two things you can do. You can go inspect the property you can check for water leaks, any water damage or issues with mould. If you see the air conditioning working, you can look for cracks in the walls, roof, ceiling area, any cracks in the concrete, you can see how busy the tenants are, talk to the tenant. Spend some time in the area come back when the Agent’s not there to do a better inspection. Also, look on Google Maps and have a look at the roof of the property. If you can’t get a pest and building inspection done, the least thing I would say is to get someone to fly a drone over the top of the building (if it’s a tall building). If it’s not get a ladder and go up yourself. Then you get to know the condition of the roof because the roof is one of the most expensive things. Make sure you get your tenant Ledgers, so you can check that they are paying rent and that they’re paying rent on time. Make sure you know your outgoings. Checking for spikes in outgoings is really important because often, when property is going to auction, you’ll find that the insurance is improperly done from previously, if it’s under-insured, your insurance will spike – get an insurance quote done properly!

Following that, make sure that you check for any other capital works that may come up to the property. So that means is there anything that is likely to be replaced? Are there awnings that needs to be done? Are there electrical issues? Check the electrical boards. Are there any compliance issues with mezzanine floors? What about any fire compliance problems? Asbestos? Check those things. Make sure you do your due diligence! You really need to stay on the agent to make sure you get on top of that due diligence as you do it.

The most important tip for preparing for auction is making you ‘feel comfortable’ and making sure you know the property. So when you go to auction, you know what you’re bidding against, you know the area, you know the property and you know what the exit strategy for the property is. You know that you can pay, you know whether it is $100k, or $150k or $200k. But you know what you’re planning to do if worst case scenario was the best case scenario, never run your numbers. That is how you get prepared for auction.

Now do not be misled that during an auction, you aren’t necessarily going to get the property any cheaper. Auctions reflect what the market is delivering. Auctions reflect what’s happening in the market, sometimes you could get lucky and there could be three people that turn up to auction rather than thirty people. There have been times we turned up in 2014 – 16 (when commercial property wasn’t the favourite) when only one or two people turned up.

Be prepared. Preparation is the key! Make sure that you buy at market rate and make sure you buy well. Without preparation, you are going to lose out because the vendor was hoping that with emotion and bidding, it’s going to push the prices up and then you will pay ridiculous yield for a property in an area that’s going to take many years for you to recover.

But if you’re prepared (and not emotional), you run the numbers and you know your numbers and you know what you can get out of the property. Look at the upside. Can you do anything to add value to the property? Could you increase the rent on certain properties? Can you swap out a tenant? Could you rent out a car space? Could you put in an ATM or anything else you need to add to the property to increase the return? Have that game plan as well.

Know your Agent and understand that it is in his best interest to sell the property. Their main aim is to get their commission. They are going to make all sorts of promises to get that property sold. So know your numbers, believe in what you know and stick to it.

That is the best way to win an auction. Remember that there’s always that one person who’s willing to pay higher than you to get the property, you might as well let them have it. Don’t be greedy, there will be other properties if this one does not work out.

So really stick to doing your due diligence upfront, know your numbers, have your finance lined up, get the maximum amount of time for settlement and go to auction. Don’t be emotional. The less emotional you are, the better you will negotiate! Work through the numbers. Stay calm, know what you’re buying and good luck at auction.

So with that in mind, if you want any tips you want us to help you at auction or you want us to have a look at property assessor to help you build a financial freedom through commercial property.

To learn more about Commercial Property Investing, visit www.unikorn.com.au

Recent Deals:

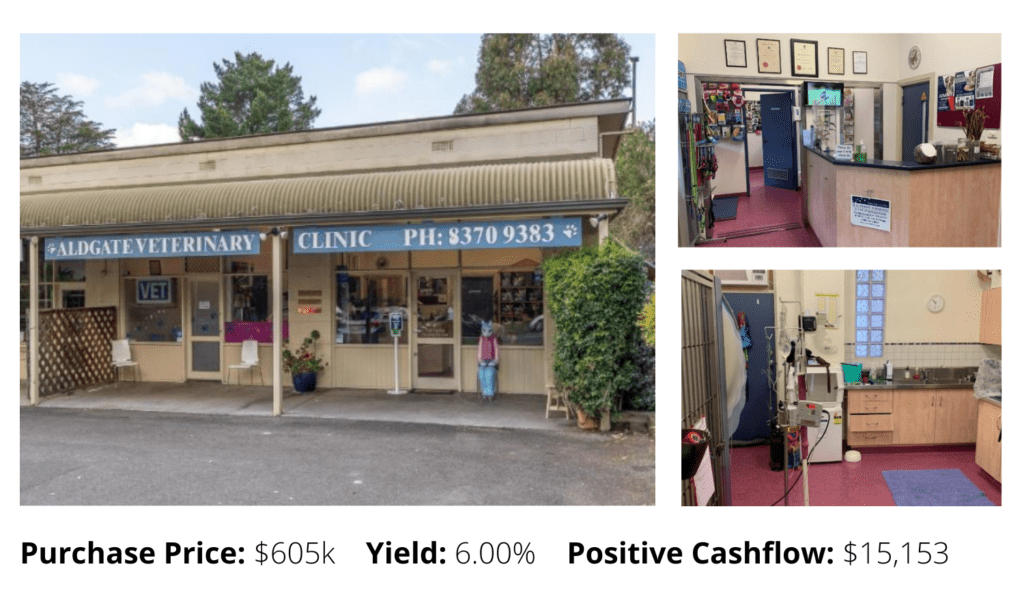

Aldgate SA 5154

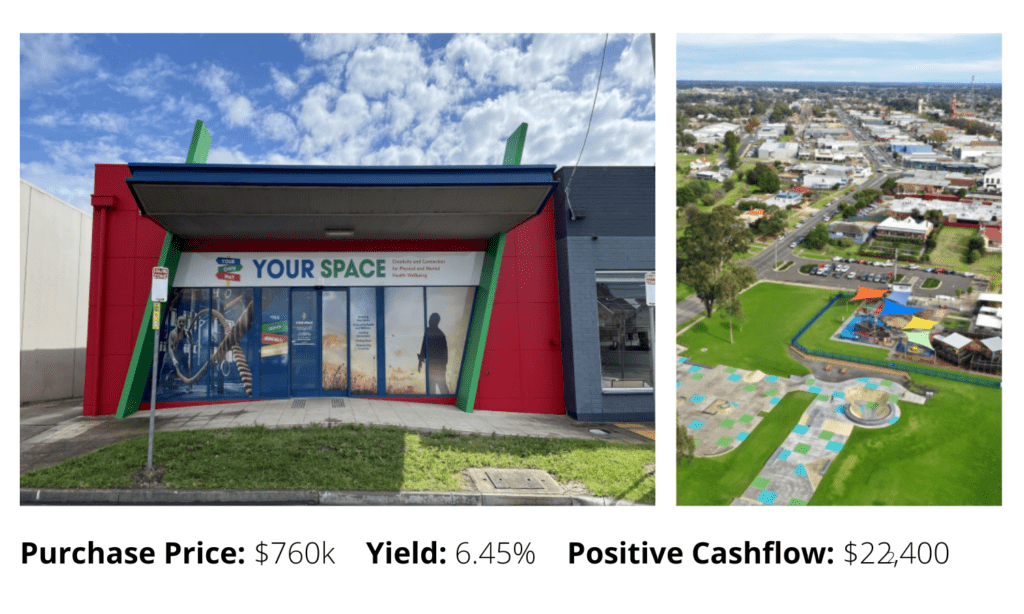

Macleod Street, Bairnsdale

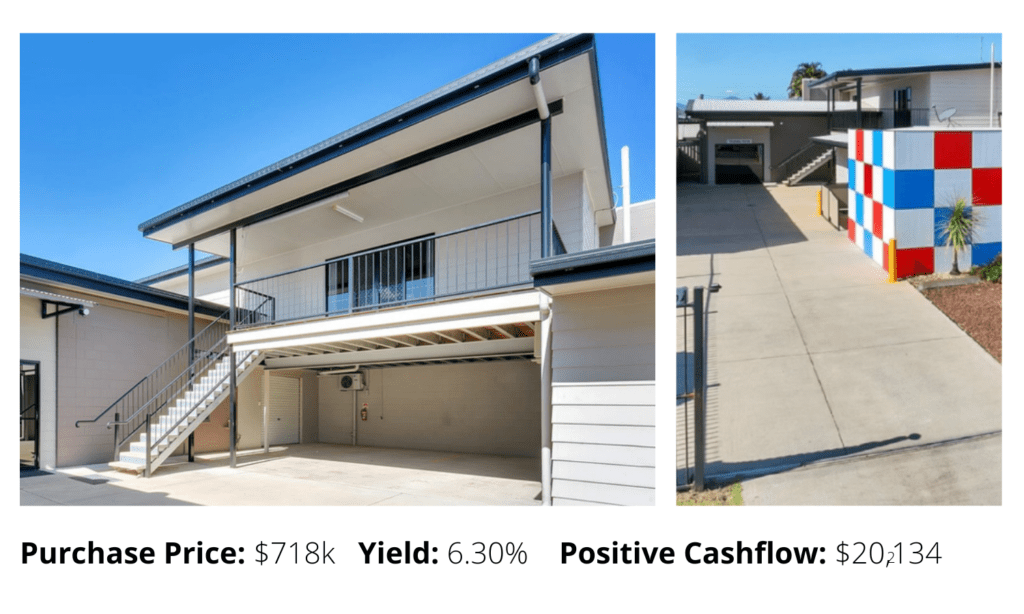

Burleigh Heads QLD 4220

Bungalow QLD

Testimonials

“We wanted to say a BIG thank you to Helen and her team of professionals. We were very nervous getting into the commercial space as it was unknown territory for us. Helen understood what we required for our strategy and made it happen. Her team of professionals range from loan specialists, solicitors, due diligence team and commercial experts. This made our journey

from the beginning (putting an offer down) all the way to settlement, very smooth and gave us confidence.

Would not hesitate to highly recommend Helen to anyone that is looking to embark in the commercial

space and we are looking forward to our next deal with

Testimonials

“Right from the beginning with strategy planning Helen has guided us in a professional manner. Her team has been very helpful in explaining the due diligence process to novices like us. We are very happy with our first commercial property purchase yielding 7%. Could not have done that without Helen and her team. We are looking forward to building our portfolio with more purchases like these. The great aspect of this experience has been the fact that we could always access Helen and her team at short notice for even minute questions.”

Testimonials

“It’s been a great experience working with Helen in purchasing my second commercial property. The previous buyer’s agent I engaged with has good reputation in the market but could not find me a property for almost 4 months, so I decided to go with Helen. Helen was very efficient in finding me a great property. Huge thanks to Helen and her team for all the work you’ve done in the whole process. Will definitely purchase more with you in the future!”

Testimonials

“Helen and her team did a wonderful job. The whole process was taken care of. Everything from lease and building DD to finance was all handled quickly and professionally.

Thanks again to all of you. I’m looking forward to the next deal.”