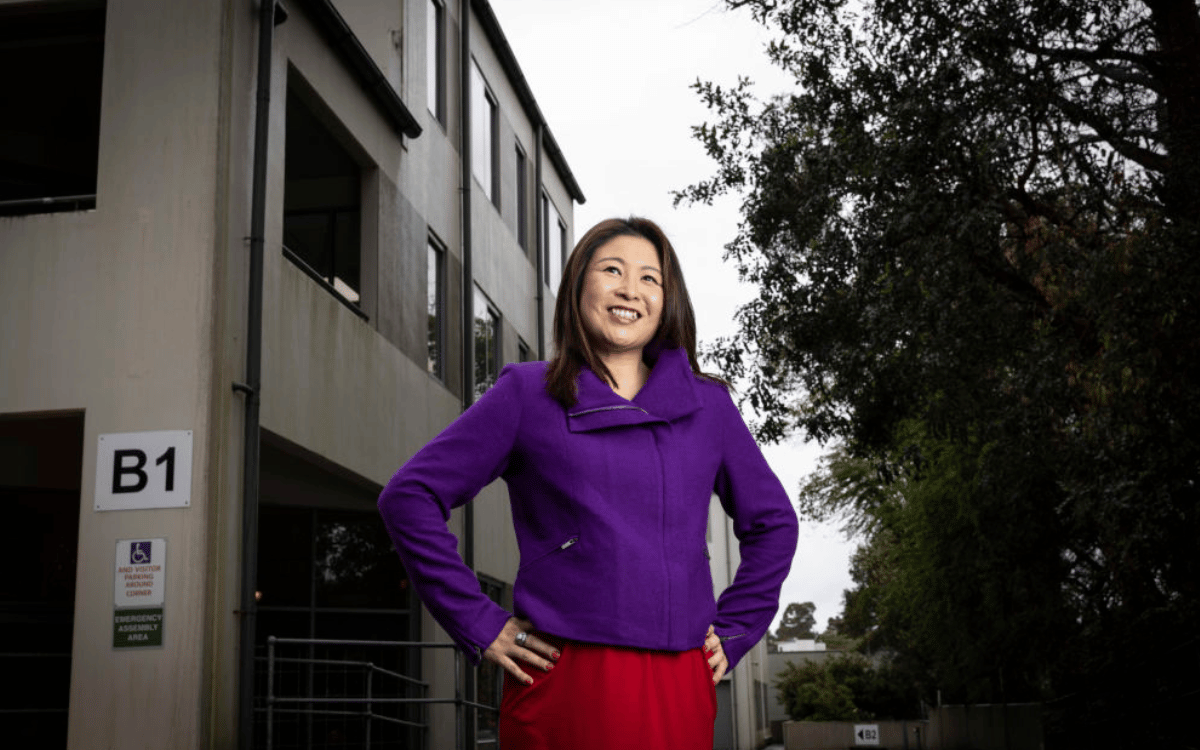

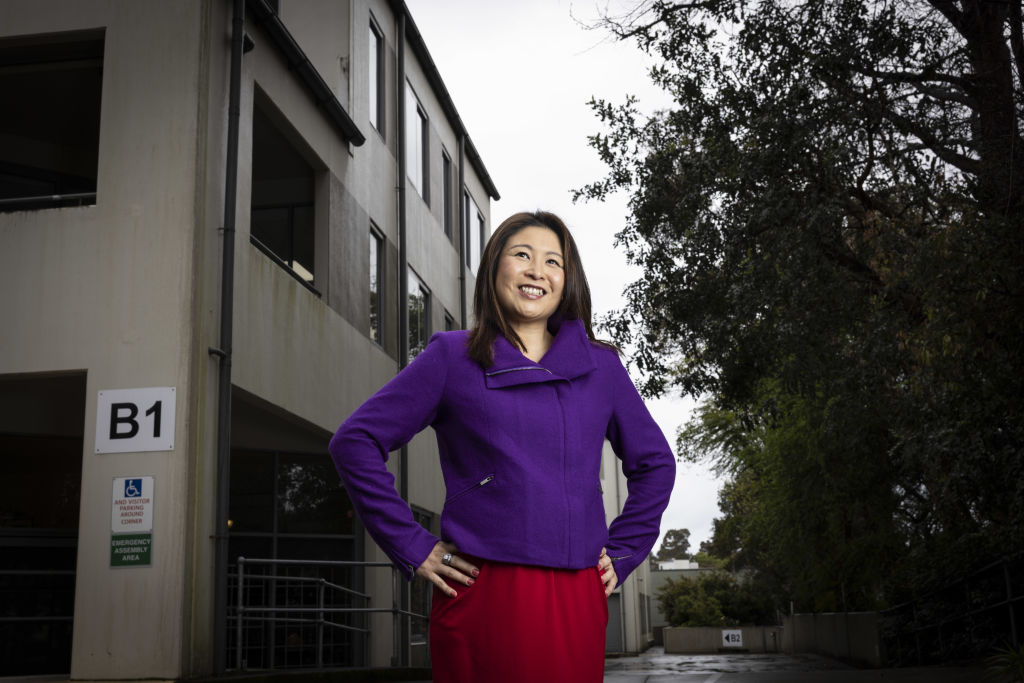

‘It’s about embracing a different mindset’: How Helen Tarrant started out in commercial property

Sue Williams | Commercialrealestate.com.au

Every week, beauty therapist Helen Tarrant would pay the $400 rent on her premises in Sydney’s northern beaches, and marvel that her landlord would then take off fishing for the week.

His life seemed so easy; she wondered if investing in commercial property could be the secret to tapping into a secure financial foundation.

So, in 2012, instead of buying a one-bedroom-plus-study apartment, Tarrant took a deep breath and bought a 52-square-metre shop in the back of an arcade in North Sydney for $360,000.

She’s never looked back. Today, 10 years later, she has a commercial property empire worth more than $30 million.

“When I started, I didn’t know anything about commercial property,” said Tarrant, now 41. “But I could see the cash flow was much better than in residential property, which was often negatively geared, so I thought I’d just give it a go.

“After a while, I realised, ‘Wow!’ The tenant paid his rent on time and wasn’t going to run away, and so I had that cash flow plus there was capital growth as the secondary strategy – which tends to be the other way around in residential. So, then I bought another one, a fish and chip shop and beauty therapy shop in Rockhampton for $580,000 at a 9 per cent yield.”

As a result, Tarrant has now written a book about buying commercial property called Cashed Up with Commercial Property: A Step-by-Step Guide to Building a Cash Flow Positive Portfolio, published by Wiley. She hopes the educational guide makes the industry easy to understand and accessible to all.

“More people are now looking at commercial property for investments, but there’s still not enough information out there,” said Tarrant, who now works as a commercial buyer’s agent with her company Unikorn, while also running webinars and investment ‘bootcamps’ with more than 200 videos on YouTube. “But hopefully the book will help these people.

“I want to make sure people are educated in commercial property and in what you can do. It’s about embracing a different mindset and, while it’s a learning curve, the pay-off – literally – is worth it. Commercial property is now my passion.”

One agent she’s bought and sold property through is Michael Hatz of Doran Commercial. He says he loves the way she’s educating people about the ease of investing in commercial property and making it much more accessible.

“Right now, she’s in the position of bringing in about $800,000 a year in purely passive income,” he said. “And she’s teaching people about how they can start to replicate that, maybe not with those figures, but by starting small.

“I think, in the past, people thought they had to be super-wealthy to invest in commercial, and that was something only big companies, institutions and super funds did, but she’s showing them that it is a great way of building wealth.

“You can buy something that’s $600,000 or $700,000, rather than $2 million, and you can raise the 35 per cent deposit with equity in your home or super fund. Helen’s breaking down the barriers for people.”

Certainly, while Tarrant started small, she quickly realised she could use her equity in her existing portfolio to buy more and also that she could purchase a property and renovate it and add value in just the same way that others refurbish and extend houses and apartments to make the most of their investment. She bought a vacant shell of a building, subdivided it, painted and carpeted it, and immediately started earning revenue.

Buying and selling her properties at the right time also brought regular windfalls. That first North Sydney shop, for instance, that she’d bought on an 8 per cent yield and tenanted with a restaurant, she sold nine years later for $1,050,000 – nearly three times what she’d paid for it.

In 2014, she bought a whole floor on Sydney’s Pitt Street for $1.4 million – probably what she could have paid at the same time for a three-bedroom penthouse apartment – refurbished it into little tenancies and sold it for $2.1 million two years later.

“When I started, I looked everywhere for more information about how to invest in commercial property, but I couldn’t find anything,” said Tarrant, who now has about 80 per cent of her portfolio in the office and retail space, and 20 per cent in industrial. “There were books published in America, but they didn’t apply to Australian circumstances. Brokers and accountants could advise you, but that’s sometimes not unbiased advice.

“At the same time, there is so much information out there on the residential market about how it works and what strategies you can use. I think that’s why so many people invest instead in the residential market, and ignore the opportunities the commercial market offers. They just don’t know enough about it.”

Recommended for you

‘It’s about embracing a different mindset’: How Helen Tarrant started out in commercial property

Cash flow and future proofing – a commercial vs residential…

Cash flow and future proofing – a commercial vs residential property SPECIAL

Cash flow and future proofing – a commercial vs residential…

Has the stock market bottomed? + Rudi & Kelli on the stocks they like right now!

Has the stock market bottomed? + Rudi & Kelli on…

Why a car park could be the smartest investment you make in 2022

Why a car park could be the smartest investment you…