Business Interruption Insurance Protection – Essential or Just Another Expense?

Contributing Author: James Dunstan (Method Insurance Brokers)

Welcome to our latest market outlook written by our insurance partner at Method Insurance Brokers.

Their in-depth analysis and insights into the interest rate and inflation tug-of-war are incredibly informative, making it a must-read for both seasoned investors and those new to the world of finance.

We’re excited to share this informative article with you, and we hope you find it valuable as you navigate the complex world of Commercial Property.

Business Interruption Insurance

The purpose of Business Interruption (BI) is to protect against a loss of revenue caused by an insurance event. For property owners, your revenue is ‘gross rental income’.

While the terms of a lease will include many protections for the property owner, there are circumstances where your tenant can stop paying rent because of damage caused to your property by peril.

You may not think twice about insuring your asset against fire and other perils. Purchasing property insurance on the building provides protection against the asset only. Business interruption provides protection against loss of gross rental income while your property is unable to be tenanted following an insured event.

- Property insurance covers rebuilding the asset.

- Business interruption covers the loss of gross income, while the asset is being rebuilt.

Where finance is involved, protecting the rental income generated from your asset is essential.

Business Interruption cover is not automatic, it is an optional section under most policies therefore do not assume if the asset is insured, that business interruption is automatically covered.

Business interruption only covers specific events and the cover is typically triggered where an insurable loss is covered under the property section of your policy. Typically a fire, storm or water damage loss which renders a property untenantable will trigger a business interruption claim.

If the property policy does not respond to the claim, business interruption cover will not normally be triggered. If you do not have flood included in your property cover, the business interruption policy will not cover loss of rent following a flood event.

A business interruption policy can extend to include cover for additional events where there is no damage to the property, for example prevention of access caused by an insured event or certain events which cause the property to be closed by authorities. Typically these types of covers are only triggered where your tenant has means under the lease to stop paying their usual rental payments to you.

Business interruption does not cover ‘tenant default’ (where the tenant withholds rent due to a commercial dispute). Cover for tenant default may be available in the insurance market, however such coverage can be difficult to obtain.

Insurers do not cover business interruption caused by communicable disease, including pandemics or endemics.

Breaking it down – How does Business Interruption insurance actually work?

The coverage begins on the date of the damage and/or loss and continues until the rental income is restored to the level it would have been if the loss had not occurred, or to the end of the Period of Indemnity (POI). The POI duration is selected by the policy holder when the coverage is purchased. The period is stated in months on the policy schedule and can usually range from 6 months to 36 months, depending on the insurer.

Due to the high demand on the construction industry, shortage of labour and supply chain issues, property owners need to consider increasing their POI to ensure adequate coverage. Determining the length may depend on location, building size, materials and size of the event (singular or large catastrophe) among other factors.

Furthermore, delays in the project timeline may also be caused by factors such as obtaining development approval from the council or undergoing investigations by the fire department, WorkCover and other relevant authorities.

During an insurance event, there are usually additional costs incurred beyond the loss of revenue to consider such as the cost to prepare your claim (accountants professional fees).

You can also insure Additional Increase Cost of Working to cover additional costs incurred to avoid a loss of rental income. For example, hiring a portable toilet block where your office toilet is unusable following an insured event.

These costs can be significant, especially for larger losses and your insurance broker should discuss these options with you.

Don’t get caught out – Why underinsurance is trouble waiting to happen!

Property managers are crucial in providing accurate information especially if a policy holder is unsure. Consult your property manager for precise rental information. Ensure your declared rental income matches the terms of your lease.

Underinsurance in a business interruption policy can occur when a policy holder insures for less than the actual gross rental income.

Key Consideration Factors:

- Was CPI applied to the lease, and if yes, is it a fixed or market rate?

- Has the occupancy rate increased since your last review?

- Have any tenancies changed, with the new tenants paying a higher rate?

- Has there been any building extensions, if so, has your rental income increased?

- Is your lease inclusive of exclusive of outgoings?

- Are you registered for GST?

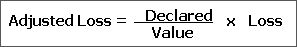

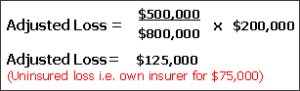

As an insurance broker we work closely with various other companies that provide value to our policy holders. Another company that we utilise the services of is LMI Group who focus primarily on Business Interruption. See below an example from LMI of how underinsurance can be calculated.

If we insured for $500,000 and the actual gross rental is $800,000 at the time of the loss. At $200,000 the claim would be adjusted down to $125,000, leaving the property owner with a self-insured loss of $75,000.

Business Interruption insurance is more affordable than you might think!

The cost of Business Interruption insurance is typically determined by a number of factors, including the insured value, period of insurance and prior loss experience. Insured value refers to the maximum amount of coverage that the policy will provide in the event of a business interruption. The higher the insured value, the higher the premium will typically be.

The period of insurance is the length of time for which the coverage will be in effect. This can range from a few months to several years, depending on the needs of the business. The longer the period of insurance, the higher the premium will typically be.

Prior loss experience is another important factor that can impact the cost of Business Interruption insurance. If a business has a history of losses due to business interruption, the premium may be higher to reflect the increased risk. Conversely, if a business has a good track record of avoiding business interruptions, the premium may be lower.

Other risk factors, such as the details of the construction of the business premises and the details of any tenants, may also impact the premium. For example, if a business is located in an area prone to natural disasters, such as weather perils i.e. cyclones or bushfires, the premium may be higher to reflect the increased risk.

In the instance where you choose not to cover damage and/or loss caused by a flood event, your insurance premium will not be impacted even if your business is located in a flood-prone area.

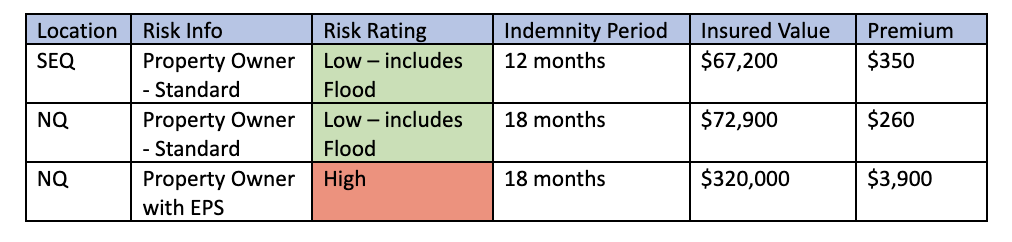

Examples of premium scenarios below:

Calculate with Confidence – Business Interruption Calculator

An online Business Interruption calculator is a helpful resource for calculating your Gross Rental Income. The LMI BI Calculator is specifically designed to accommodate the unique wordings of each insurer’s business pack, making it a dependable and accurate tool. As the wording of each business pack may vary from one another, it is important to use a calculator that is designed to cater to the specific language used in your policy. These calculators will eliminate guesswork and provide a more precise calculation of your Gross Rental Income, providing peace of mind and saving you time and money in the long run.

Didn’t realise insurance was so interesting? To find out more…

Method Insurance Brokers is a company that focuses on providing commercial property insurance. Whether you are a seasoned property owner or just starting out, our small team of experts are ready to provide guidance and advice to help you make informed decisions.

We understand that investing in commercial property can be a significant financial commitment, and protecting your investment is crucial. Therefore getting the right insurance is crucial. Every commercial property is unique due to the tenant mix, floor or fire risks.

For more commercial property education on insurance , please do not hesitate to contact James Dunstan at Method Insurance Brokers. We look forward to hearing from you and helping you protect your commercial property investment.

Contact: James Dunstan

Mobile: 0404850281

Email: james@methodinsurance.com.au

Recent Deals:

Garbutt, QLD

Purchase Price: $817,000

Yield: 7.32%

Positive Cashflow: $18,936

Currajong, Townsville

Purchase Price: $900,000

Yield: 8.51%

Positive Cashflow: $31,545

Cashed Up Book

Testimonials

“We wanted to say a BIG thank you to Helen and her team of professionals. We were very nervous getting into the commercial space as it was unknown territory for us. Helen understood what we required for our strategy and made it happen. Her team of professionals range from loan specialists, solicitors, due diligence team and commercial experts. This made our journey

from the beginning (putting an offer down) all the way to settlement, very smooth and gave us confidence.

Would not hesitate to highly recommend Helen to anyone that is looking to embark in the commercial

space and we are looking forward to our next deal with

Testimonials

“Right from the beginning with strategy planning Helen has guided us in a professional manner. Her team has been very helpful in explaining the due diligence process to novices like us. We are very happy with our first commercial property purchase yielding 7%. Could not have done that without Helen and her team. We are looking forward to building our portfolio with more purchases like these. The great aspect of this experience has been the fact that we could always access Helen and her team at short notice for even minute questions.”

Testimonials

“It’s been a great experience working with Helen in purchasing my second commercial property. The previous buyer’s agent I engaged with has good reputation in the market but could not find me a property for almost 4 months, so I decided to go with Helen. Helen was very efficient in finding me a great property. Huge thanks to Helen and her team for all the work you’ve done in the whole process. Will definitely purchase more with you in the future!”

Testimonials

“Helen and her team did a wonderful job. The whole process was taken care of. Everything from lease and building DD to finance was all handled quickly and professionally.

Thanks again to all of you. I’m looking forward to the next deal.”